The New Media Investment Group’s quarterly earnings report was full of happy news. The parent company of GateHouse Media is doing great.

• Thanks to the profits ($19.1 million in free cash flow) pouring out of markets like Springfield, Peoria and Rockford, the New Media board boosted dividends by 10 percent, to from 30 cents to 33 cents per share.

• Although New Media Investment Group stock got a nice bump, up to nearly $24 per share, after this news broke. Media analysts remain bullish on the stock, projecting further growth.

• The company raised $152 million with a new equity offering. That helped keep New Media in acquisition mode while keeping its debt ($373 million) within reason.

• After acquiring Halifax Media and substantial assets from Stephens Media, the company pursued additional deals. More deals “are in the pipeline” as CEO Michael Reed noted. It expects to meet its goal of $1 billion in acquisitions by the end of 2016.

• Propel Marketing revenues were up 51 percent on a “same story basis”.

• The company is positioned to pay minimal taxes for years to come.

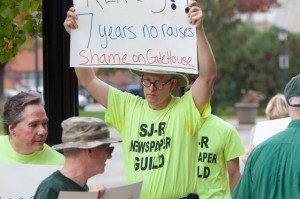

Despite all of this happy news, the company is maintaining a hard line in Guild negotiations, offering no raises to journalists who have endured a years-long wage freeze at highly profitable newspaper operations.

Good news for our members to take from the earnings call: When an analyst asked about further cost cutting at the newspapers, the company noted it was “in the late innings of cost reductions.” So there’s that. Perhaps the raises will come in extra innings.

Bad news for our members: The company noted its real estate holdings of $175 million to $200 million, which could be liquidated to keep the cash flow pouring out of the markets.

The newspaper buildings could be sold outright or sold with a lease-back arrangement for the newspapers. So our journalists shouldn’t be too comfortable at their desks.

(For those wondering if Wes Edens and Fortress Investments are doing OK, worry not. Fortress raked in a $2.9 million management fee for being the money guys behind this whole adventure.)

Reed and other New Media executives fielded questions from analysts, who focused on numbers crunching instead of core business issues.

Here are questions analysts should have asked:

How long will New Media/GateHouse properties remain “strong, trusted local brands” in the face of relentless cost-cutting, constant staff turnover and shrinking news holes in the print product?

The Guild will continue engaging readers in key New Media markets like Providence, Springfield and Rockford where our contract battles are ongoing. Our public campaigns have hit a responsive chord with readers who are well aware of the declining quality of these “strong, trusted local brands” under GateHouse management.

When will New Media invest more in its core product, journalism?

In its news release, New Media noted: “As the Company continues to grow through acquisitions, we are able to leverage our scale to increase our buying power and offset our continued investments in corporate infrastructure, digital initiatives and tuck-in acquisitions.”

Ah, but what about the news-gathering operations? Those are a fraction of their pre-GateHouse size. The loss of reporting experience and institutional knowledge is exacerbated by the outsourcing of copy editing functions to employees in Austin, Texas — who have little knowledge of the communities served by the newspapers.

Can the company maintain “strong, trusted brands” with this approach?

How long will circulation revenue — the largest single revenue piece at 32 percent — remain a “stable category”?

Print circulation is declining at New Media properties, in some cases precipitously. The company has offset that revenue loss by raising prices. After buying the Providence Journal, for instance, the company doubled the newsstand price. Can New Media keep charging more and more for a smaller and smaller newspaper? Can New Media build a stronger digital subscription base with less and less quality content?

Is the acquisition spree masking so-so performance of the stripped down existing properties?

As Saibus Research noted, “Although NEWM has posted impressive reported growth due to its acquisition spree, its adjusted pro forma results are underwhelming.”

Can the growth Propel Marketing offset the steady decline of print advertising?

Propel may be a “growth lever” as analysts would say, but it is a small lever. Earlier this year, Saibus Research noted this: “We think that investors should recognize that revenue from Propel only represents 2.8% of NEWM’s total consolidated revenue and that growth from Propel will largely be offset by declines in NEWM’s traditional newspaper publishing operations.”

Guild members in sales note that Propel is a difficult sell to the mom-and-pop business in the smaller GateHouse Media markets. In the larger markets, Propel faces heavy competition.

All of that is food for investor thought. You can visit this website to learn more about how you can make money with stocks.